Anticipating stock price movements for LPA: A crucial element in investment decisions.

Predicting the future price of LPA stock involves analyzing various factors influencing the company's performance. These factors include, but are not limited to, market trends, financial reports, competitive landscape, and overall economic conditions. An accurate prediction requires a thorough understanding of the company's strengths, weaknesses, and potential opportunities. For example, a detailed examination of past earnings reports, news about the company, or industry trends can be crucial components of a prediction model.

Forecasting stock prices is a complex endeavor with no guaranteed success. However, informed analysis can increase the probability of making sound investment decisions. Understanding factors like earnings per share (EPS), revenue growth, and debt levels can contribute to a more nuanced understanding. Furthermore, assessing the stock's historical performance relative to the broader market can provide valuable insights into potential future price movements. The benefit of accurate predictions lies in the potential for higher returns and the reduction of investment risks.

This discussion provides a foundational understanding of the importance of analyzing stock performance to make informed decisions. Following this introduction, we will delve deeper into specific techniques, tools, and methodologies frequently used in stock prediction for LPA and other companies.

LPA Stock Prediction

Accurate prediction of LPA stock prices requires a comprehensive understanding of various factors. Successful prediction hinges on the analysis of these key aspects.

- Market trends

- Financial reports

- Company performance

- Economic indicators

- Competitive analysis

- Analyst opinions

- Historical data

Predicting LPA stock performance demands a thorough review of market trends and financial reports. Company performance, alongside economic indicators, provides valuable context. Scrutinizing competitive analysis and analyst opinions adds further depth. Leveraging historical data aids in identifying patterns and trends. Integrating these factors offers a more nuanced perspective, improving the potential for informed decisions. For example, a strong earnings report paired with positive market sentiment might suggest a price increase, while concerns about the industry's future growth could signal potential downward pressure. By combining these factors and continually analyzing evolving conditions, more reliable forecasts can be achieved.

1. Market Trends

Market trends play a critical role in stock predictions, particularly for LPA. A robust understanding of broader market movements is essential for evaluating the potential performance of LPA stock. Positive trends in the overall market often correlate with increased investor confidence, potentially boosting demand and prices for LPA stock. Conversely, negative market trends, such as economic downturns or industry-wide anxieties, can depress stock valuations, impacting LPA's price. For example, a surge in technology sector investments during a period of heightened investor optimism could favorably affect LPA's stock if LPA shares are associated with related sectors.

Specific market trends relevant to LPA predictions encompass industry-specific conditions. A rise in demand for LPA's products or services, driven by evolving consumer preferences or technological advancements, could trigger a positive stock response. Conversely, if LPA faces competition from emerging market players or experiences setbacks in key partnerships, stock performance might suffer. Historical data demonstrating the relationship between broader market sentiment and LPA stock performance provides valuable insights for assessing future potential. For instance, a correlation between rising interest rates and declining LPA stock prices over several periods suggests a potential causal relationship, a factor to consider within prediction models.

In summary, market trends are not isolated indicators but rather integral components of a comprehensive LPA stock prediction analysis. Understanding how market forces influence investor sentiment and, in turn, stock prices for LPA is crucial for informed investment decisions. However, predicting stock performance accurately remains challenging due to the intricate interplay of numerous variables. Analysts must meticulously assess not only broad market trends but also LPA's internal strengths and vulnerabilities alongside external factors to craft more accurate predictions.

2. Financial Reports

Financial reports are fundamental to LPA stock prediction. These reports provide critical data on a company's financial health, performance, and future prospects. Profitability, revenue growth, and debt levels, as revealed in financial statements, are essential components in evaluating investment potential. Analyzing these figures allows for informed decisions regarding LPA stock valuation and potential returns. A consistent pattern of increasing profits, coupled with expanding revenue, often suggests favorable investment prospects, potentially leading to positive stock predictions. Conversely, declining profits or escalating debt levels could signal potential challenges, prompting more cautious assessments of stock value.

The importance of financial reports extends beyond mere profitability. Metrics like earnings per share (EPS), return on equity (ROE), and operating margins offer a deeper dive into operational efficiency and long-term sustainability. A company showcasing steady growth in these key indicators often attracts investor confidence, which can translate into a positive effect on stock prices. For instance, if LPA consistently reports higher EPS than its competitors, coupled with strong revenue growth, it may indicate a favorable investment landscape for LPA stock. Conversely, if LPA experiences a sharp decline in these metrics compared to previous periods or industry benchmarks, it could prompt analysts to revise their stock price projections. The inclusion of comprehensive financial analysis, based on readily available data within these reports, therefore, is crucial for crafting accurate stock predictions. External factors, such as economic conditions and industry trends, should also be considered alongside the internal financial data from LPA's reports for a comprehensive picture.

In conclusion, financial reports are indispensable tools for evaluating LPA stock performance and potential. By analyzing key financial metrics, stakeholders can gain a clearer understanding of the company's financial health and future prospects, thereby informing stock price predictions. However, predicting stock movements is inherently complex, and financial reports should be considered alongside other factors, like market trends, competitive pressures, and economic conditions, for a more complete picture. Ultimately, a deep dive into LPA's financial reports provides a critical data point in a sophisticated process of stock prediction.

3. Company Performance

Company performance directly impacts stock predictions, particularly for LPA. A company's operational success, measured by various metrics, strongly influences investor confidence and, consequently, stock valuation. Analyzing these performance indicators is crucial in forecasting likely future stock price movements.

- Revenue Growth and Profitability

Consistent revenue growth and healthy profitability are key indicators of a company's strength. Strong revenue suggests increasing demand for products or services, indicating a potentially successful business model. Profits, after deducting operational costs, demonstrate efficient resource utilization and profitability. High revenue growth coupled with robust profit margins often leads investors to perceive LPA as a promising investment, positively impacting stock predictions. Conversely, declining revenue or persistent losses can lead to concerns about the company's future prospects, potentially resulting in negative stock predictions.

- Market Share and Competitiveness

A company's market share position and ability to compete effectively significantly impact its stock value. A growing market share suggests dominance or success in the market segment, increasing investor confidence. Conversely, a declining market share might indicate a weakening position relative to competitors, potentially leading to a downward trend in stock predictions. Analysis of the competitive landscape, considering LPA's relative position, is crucial for assessing future performance and stock price predictions.

- Operational Efficiency and Cost Management

Operational efficiency, measured by the ability to manage costs effectively, is essential for sustained profitability. Cost-effective operations allow a company to maximize returns, a crucial factor in attracting investors and influencing positive stock predictions. Conversely, inefficiencies or escalating costs can signal potential problems, potentially lowering investor confidence and influencing negative stock predictions. Examining LPA's operational metrics and comparing them to industry benchmarks provides a critical insight for forecasting future performance.

- Innovation and Product Development

A company's capacity for innovation and new product development is another critical element in evaluating long-term potential. New products or services can generate new revenue streams, increasing investor confidence and influencing positive stock predictions. Conversely, a lack of innovation or slow product development may suggest a stagnant market position, potentially leading to negative stock price predictions. Analyzing LPA's track record of innovation and future product pipeline is crucial for understanding its future potential.

Ultimately, company performance, encompassing revenue, profitability, market share, operational efficiency, and innovation, provides a critical dataset for investors to evaluate LPA's potential. By analyzing these components, along with other relevant factors, more accurate predictions of LPA stock performance can be made.

4. Economic Indicators

Economic indicators significantly influence stock predictions, including those for LPA. These indicators reflect the overall health and trajectory of the economy, impacting investor sentiment and, consequently, stock prices. A strong economy, characterized by robust growth and low unemployment, typically fosters investor confidence, potentially driving up stock prices. Conversely, an economic downturn, marked by recessionary pressures or rising inflation, often dampens investor enthusiasm and can lead to stock price declines. The connection between economic indicators and stock predictions stems from the impact of economic conditions on corporate earnings, market sentiment, and investment decisions.

Consider the impact of interest rate hikes. Increased borrowing costs, a common response to inflation concerns, can negatively affect corporate profitability, especially for companies with significant debt obligations. This, in turn, can impact investor confidence and potentially lead to a downward trend in stock prices, including LPA's. Conversely, a period of low interest rates might stimulate economic activity and boost corporate profits, leading to positive stock price movements. Similarly, changes in consumer spending, as indicated by retail sales data or consumer confidence indices, can reflect economic health and its impact on the demand for LPA's products or services, thus influencing predictions. Furthermore, employment data provides insights into overall economic strength. A healthy job market often corresponds with strong consumer spending and corporate earnings, creating a positive feedback loop that can support stock predictions.

Understanding the interplay between economic indicators and stock predictions is crucial for investors in LPA stock. Analyzing trends in economic indicators allows for a more informed assessment of the broader economic context in which LPA operates. This, in turn, assists in formulating more accurate predictions by incorporating the prevailing economic climate into the analysis. However, the relationship is not deterministic; numerous other factors, such as industry-specific trends and company-specific performance, also play a role. Predicting the exact impact of economic indicators on a particular stock, like LPA, remains challenging due to the complexity of the interaction among these variables, and the inherent uncertainty associated with future economic conditions. Despite these challenges, careful analysis of economic indicators remains an indispensable component of any comprehensive stock prediction strategy for LPA.

5. Competitive Analysis

Competitive analysis is a crucial component in predicting LPA stock performance. Understanding the landscape of competitors is essential for evaluating LPA's market position, potential growth, and susceptibility to external pressures. A comprehensive analysis of competitors identifies strengths, weaknesses, and opportunities, informing a more accurate projection of LPA's future stock price.

- Market Share and Positioning

Analyzing competitors' market share provides a benchmark for LPA's current position. Understanding how LPA compares to competitors allows for an assessment of its relative strength and potential for expansion. This comparison considers factors like brand recognition, customer loyalty, and distribution channels. For instance, a significant competitor gaining market share could suggest a potential decline for LPA, necessitating adjustments to the prediction model. Conversely, a stable or growing market share for LPA, compared to competitors, would contribute to a more optimistic outlook for stock performance.

- Pricing Strategies and Product Differentiation

A comparison of competitor pricing strategies and product offerings provides insights into LPA's pricing power and the strength of its product differentiation. If competitors consistently offer similar products at lower prices, LPA may need to adjust its pricing or product features to maintain competitiveness. If LPA possesses unique or highly valued products, this could positively influence the stock prediction. Effective differentiation strategies create competitive advantages that often bolster stock performance.

- Financial Performance and Operational Efficiency

Analyzing competitors' financial performance, including revenue growth, profitability, and operational efficiency, offers a context for evaluating LPA's financial health. Stronger financial performance among competitors may increase competitive pressure on LPA. Likewise, lower operational costs in competitors could signal efficiency improvements that LPA needs to emulate or risk falling behind. These aspects impact investor confidence and contribute significantly to stock price predictions.

- Marketing and Sales Strategies

Assessing competitor marketing and sales strategies reveals insights into effective market penetration and brand building. A successful competitor's marketing tactics and strong customer acquisition strategy can provide a benchmark for potential LPA improvements. Conversely, weaknesses in competitor marketing or sales could present opportunities for LPA to capture market share. Effectively adapting and refining strategies based on competitor analysis is crucial for sustained success and positive stock predictions.

In conclusion, competitive analysis provides vital context for LPA stock predictions. A comprehensive understanding of the competitive landscape allows for a more nuanced perspective on LPA's future performance. By assessing market share, pricing strategies, financial health, and marketing effectiveness of competitors, investors can gain a more complete picture of the challenges and opportunities facing LPA, contributing to more accurate stock predictions. This insight, integrated into the overall evaluation, ultimately informs more prudent investment decisions.

6. Analyst Opinions

Analyst opinions hold significant weight in stock predictions, including those for LPA. Analyst reports, presentations, and public statements offer assessments of a company's performance, future prospects, and overall valuation. These opinions, informed by extensive research, often factor into investor decisions, potentially influencing stock prices. The connection between analyst opinions and stock predictions is a causal one. Positive assessments often lead to increased investor interest, driving up demand and, consequently, the stock price. Conversely, negative commentary can generate investor apprehension, potentially leading to a decline in stock value. This dynamic highlights the importance of analyst opinions as a component of LPA stock predictions.

Consider real-life examples. A renowned investment bank issuing a "buy" rating for LPA stock, citing positive projections for future earnings, might incentivize investors to purchase shares. This increased demand could lead to a price increase. Conversely, a downgrade to "sell" by a respected analyst, citing concerns about the competitive landscape or declining profitability, might prompt investors to sell their LPA holdings, resulting in a price decline. Such actions demonstrate how analyst pronouncements can influence investor behavior and thereby impact stock prices. The credibility and track record of the analyst issuing the opinion significantly affect its impact. A highly regarded analyst with a history of accurate forecasts tends to carry more weight than a less reputable one. The importance of considering diverse analyst opinions, recognizing biases, and performing independent analysis cannot be overstated. Integrating analyst opinions into a broader evaluation of LPA's fundamentals and market conditions is crucial to crafting well-informed predictions.

In summary, analyst opinions are an integral element of LPA stock predictions. Their influence stems from their ability to sway investor sentiment, leading to changes in market demand and stock prices. While acknowledging the potential for bias and the necessity of critical evaluation, analysts' insights, when rigorously considered alongside other factors, can contribute meaningfully to a comprehensive prediction strategy. Understanding the dynamics between analyst opinions and LPA stock predictions allows for a more nuanced appreciation of the factors driving market movements and informs more informed investment decisions. Nevertheless, stock prices remain influenced by complex variables, and no single factor, including analyst opinions, guarantees accurate prediction.

7. Historical Data

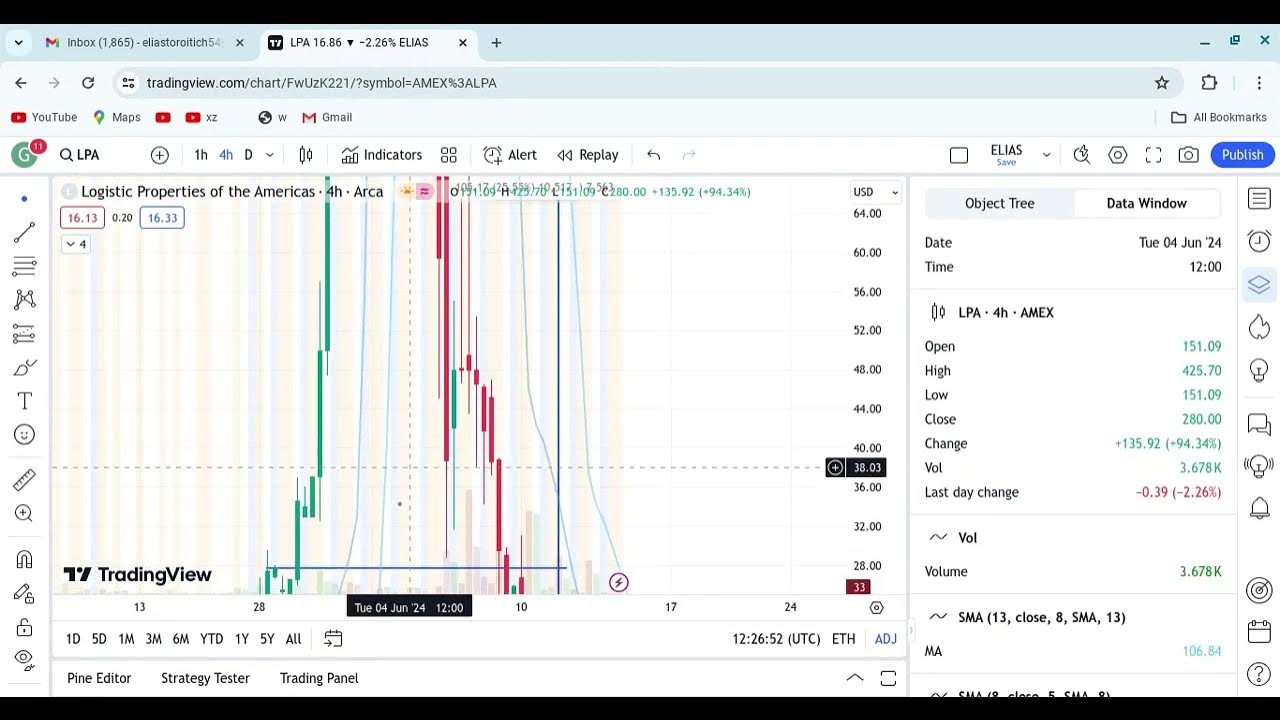

Historical data plays a pivotal role in LPA stock prediction. Analyzing past performance offers valuable insights into trends, patterns, and potential future price movements. Understanding how LPA stock has reacted to various economic conditions, market events, and internal developments provides a foundation for informed predictions. Past data offers a context for evaluating the current situation and potentially identifying risk factors or indicators of future growth.

- Trend Identification

Historical data reveals trends in LPA's stock price over time. Analyzing price fluctuations over years, months, or even days can identify upward or downward trends. For instance, if LPA stock prices consistently rose during periods of economic expansion, this pattern might indicate a positive correlation. Such trends can be used to gauge potential future movements, although correlation does not guarantee causation.

- Identifying Turning Points

Historical data pinpoints specific events or periods that marked significant changes in LPA stock price. These turning points, whether triggered by economic downturns, regulatory changes, or company-specific announcements, can provide valuable insights into how LPA stock reacts to external and internal pressures. Identifying these pivotal moments allows for a more sophisticated understanding of potential vulnerability or resilience.

- Assessing Volatility

Historical data quantifies the volatility of LPA stock. Measuring standard deviation, range, or other volatility indicators reveals the extent to which the stock price fluctuates. Understanding this volatility is crucial for risk assessment. High historical volatility suggests greater potential for price swings, demanding a more cautious approach to prediction.

- Evaluating Correlation with Key Variables

Historical data allows for the assessment of correlation between LPA stock performance and other variables. For example, analyzing stock price movements relative to interest rate changes or industry-specific trends can expose potential correlations. Identifying these correlations enhances predictive power by highlighting factors that might influence future price action. However, correlation does not necessarily imply causation.

In conclusion, historical data, when thoroughly analyzed, can provide valuable insights for LPA stock prediction. By identifying trends, turning points, volatility patterns, and correlations, predictive models can incorporate a more nuanced understanding of historical patterns. However, the past is not a perfect predictor of the future, and historical data should be used in conjunction with other pertinent factors, such as current economic conditions, to arrive at informed predictions. Historical data serves as a cornerstone but should not be the sole basis for investment decisions.

Frequently Asked Questions about LPA Stock Prediction

This section addresses common inquiries regarding LPA stock prediction. The following questions and answers provide a concise overview of key considerations for investors.

Question 1: What factors influence LPA stock predictions?

LPA stock predictions are influenced by a multitude of factors, including but not limited to: market trends, financial reports, company performance, economic indicators, competitive analysis, analyst opinions, and historical data. No single factor guarantees accuracy; instead, a comprehensive evaluation of these elements forms the basis for more informed predictions.

Question 2: How reliable are LPA stock predictions?

Predicting stock prices, including those for LPA, involves inherent uncertainty. No prediction method guarantees accuracy. While analysis can enhance the probability of a sound decision, unforeseen circumstances and complex market dynamics can affect outcomes. Therefore, predictions should be viewed as potential indicators, not definitive statements.

Question 3: What are the benefits of understanding LPA stock predictions?

Understanding LPA stock predictions can contribute to informed investment decisions. Accurate predictions can potentially enhance the likelihood of making sound investment choices and potentially reduce risks. However, predictions must be seen as one component within a broader investment strategy.

Question 4: How can historical data inform LPA stock predictions?

Analyzing historical data, including price trends, volatility patterns, and correlations with economic indicators, helps identify potential patterns and insights. However, past performance is not an absolute guarantee of future results. Historical data should support, not replace, current analysis.

Question 5: How do analyst opinions influence LPA stock predictions?

Analyst opinions, often based on research and analysis, offer valuable perspectives. However, these opinions should be critically evaluated alongside other factors and not used as the sole basis for investment decisions. Diversified perspectives from reputable analysts can provide further context.

In summary, LPA stock prediction involves a complex interplay of various factors. While prediction methods can enhance the potential for informed decisions, understanding the inherent uncertainty is crucial. No single method or prediction guarantees accuracy; therefore, investors must employ comprehensive analysis and critical evaluation.

The next section will delve into specific methodologies and tools used in LPA stock analysis.

Conclusion

This analysis of LPA stock prediction underscores the multifaceted nature of forecasting stock performance. Accurate prediction hinges on a comprehensive understanding of interconnected factors. Market trends, financial reports, company performance, economic indicators, competitive analysis, analyst opinions, and historical data all contribute to a nuanced evaluation. While no single factor guarantees accuracy, integrating these elements into a robust analytical framework can significantly enhance the likelihood of informed investment decisions. The complexity of these interactions necessitates careful consideration of potential risks and opportunities inherent in the stock market.

In conclusion, predicting LPA stock prices is a complex, ongoing process. Investors should not rely solely on any single prediction but rather conduct their independent analysis, considering the multitude of factors outlined in this examination. Further research and adaptation to evolving market conditions are paramount to making informed choices in the dynamic landscape of stock investment.

Article Recommendations