Is this publicly traded company a compelling investment opportunity? A comprehensive look at the stock performance and market implications of this particular entity.

The stock representing a specific company listed on a stock exchange is a financial instrument representing ownership in that company. This particular instrument allows investors to buy and sell shares, potentially profiting from price fluctuations. Detailed information on company performance, including financial statements, news, and analysis, is readily accessible through various financial resources.

The significance of a company's stock performance stems from its connection to the overall health and growth of the company itself. Favorable market trends, innovative products, and strong financial results generally translate into higher stock prices, benefiting shareholders. Conversely, negative news or economic downturns can depress stock valuations. Historical data, including past stock prices, earnings reports, and market trends, provide context for evaluating an investment's potential. The company's market capitalization, along with its industry position and overall financial health, play critical roles in assessing investment value and risk.

Moving forward, analysis of this particular entity will cover its market capitalization, revenue streams, competitive landscape, and historical financial performance. This approach will illuminate potential investment advantages and risks.

kspn stock

Understanding kspn stock requires examining various crucial elements. This exploration highlights key aspects for informed evaluation.

- Market capitalization

- Financial performance

- Industry trends

- Earnings per share

- Executive leadership

- Company valuation

- Stock price volatility

- Dividend history

Analyzing these aspects provides a comprehensive picture of the company behind kspn stock. Market capitalization reveals size and financial strength; performance metrics like earnings per share reflect profitability. Industry context, leadership, and valuation methods are integral to comprehensive evaluation. Stock price volatility underscores risk and reward, while dividend information reveals distribution policies. By considering these elements, investors can form a more informed view of the investment potential, considering risk and return factors.

1. Market Capitalization

Market capitalization, a crucial metric, provides insight into a company's overall size and market value. For kspn stock, understanding this metric is paramount. It reflects the total market valuation of the company, calculated by multiplying the current share price by the total number of outstanding shares. This figure signifies the aggregate investment in the company and is a key determinant of its perceived strength and influence within the market.

- Relationship to Share Price and Outstanding Shares

Market capitalization directly correlates with both the share price and the number of outstanding shares. A rising share price, assuming a stable number of outstanding shares, leads to a higher market capitalization. Conversely, an increase in the number of outstanding shares, without a corresponding increase in the company's value, can dilute the market capitalization. This dynamic is crucial for investors to grasp when evaluating kspn stock. Tracking these changes over time reveals trends and provides context to the investment opportunity.

- Indicator of Market Perception

Market capitalization reflects the collective assessment of investors regarding the company's value and future prospects. A high market capitalization suggests strong investor confidence and anticipation of growth. This is a critical aspect to consider in the context of kspn stock, since it conveys the broad market sentiment about the company's potential.

- Benchmarking and Comparison

Market capitalization allows comparison with other companies in the same industry. This perspective facilitates determining kspn stock's position relative to competitors. By evaluating the company's market capitalization against its peers, investors can better understand its relative size and strength within the industry, potentially uncovering its competitive standing and providing essential context for investment decisions.

- Impact on Investment Strategies

Market capitalization is a significant factor in determining suitable investment strategies. Different investment approaches may favor companies with varying market capitalizations. A deep understanding of market capitalization is important when considering how kspn stock fits into an overall investment portfolio and strategy. This knowledge allows investors to make informed decisions aligning with their individual investment objectives.

In conclusion, understanding market capitalization is essential for evaluating kspn stock. It provides a comprehensive view of the company's size, investor sentiment, competitive standing, and influence within the market. This metric is a cornerstone of thorough analysis, offering valuable insights into the company's investment potential.

2. Financial Performance

Financial performance directly impacts the value and trajectory of kspn stock. Key financial indicators, such as revenue, earnings, profitability, and debt levels, influence investor perception and, consequently, the stock price. Strong financial performance typically correlates with increased investor confidence, driving up the stock's value. Conversely, weak financial results often lead to decreased investor confidence and a corresponding decline in the stock price. Consistent profitability over time is a major factor in sustaining or growing the value of kspn stock.

Analyzing historical financial statements, including income statements, balance sheets, and cash flow statements, provides a critical understanding of past performance and potential future trends. For example, significant increases in revenue consistently accompanied by declining expenses and a healthy cash flow position could signal a robust financial health, suggesting positive growth opportunities and potentially supporting a rising stock price. Conversely, declining revenue, increasing debt, or sustained losses suggest financial vulnerabilities, potentially causing investor concern and affecting the value of kspn stock negatively. Careful scrutiny of these data points helps investors understand the underlying health of the company and anticipate possible future developments impacting the stock price. Comparative analysis with industry peers provides a benchmark for assessing kspn stock's performance relative to its competitors. Variations in profitability and financial health between companies can illuminate relative strengths and weaknesses, providing a more nuanced understanding of the company's standing within the broader context of the market.

In conclusion, financial performance is an essential element in evaluating kspn stock. The connection between these two is a cause-and-effect relationship where strong financial health supports increasing investor confidence and rising stock prices, while weak financial performance can lead to decreased confidence and potentially lower stock prices. Investors need a thorough understanding of a company's financial health to accurately assess the risk and reward associated with kspn stock and make informed investment decisions.

3. Industry Trends

Industry trends significantly impact the performance of kspn stock. Understanding prevailing trends within the relevant sector provides crucial context for assessing the company's potential and evaluating investment opportunities. Factors like technological advancements, regulatory changes, and shifts in consumer preferences influence the entire industry, directly affecting kspn stock's value and trajectory.

- Technological Advancements

Rapid technological advancements often reshape entire industries. Emergence of new technologies can alter production processes, create new market opportunities, or disrupt existing business models. For kspn stock, these advancements might present either significant opportunities or formidable challenges. Adaptability to new technologies and proactive investment in innovation are crucial for companies to maintain competitiveness and, consequently, for the positive performance of their associated stock. Failure to adapt can lead to diminished market share and declining stock prices.

- Regulatory Changes

Regulatory environments significantly impact industries. Changes in regulations, such as new environmental standards, safety protocols, or tax policies, can influence operational costs, pricing strategies, and market access. Understanding these changes is crucial for investors. For kspn stock, regulatory developments affect profitability and growth potential. Companies unable to adapt to new regulations might face substantial financial penalties or market disadvantages, directly impacting the stock's value.

- Consumer Preferences and Demographics

Shifting consumer preferences and demographics influence demand for goods and services. Understanding these trends helps anticipate future market needs. For kspn stock, adapting to these evolving preferences is vital. Companies that effectively respond to these changes often achieve higher market share and improved financial performance, positively impacting the stock value. Conversely, failing to anticipate and adapt to changing consumer preferences can result in market stagnation or decline.

- Competitive Landscape

The competitive landscape in an industry evolves constantly. Emergence of new competitors, changes in pricing strategies, or innovative approaches from existing players impact market share and profitability. Investors evaluating kspn stock must consider the intensity and nature of competition within the industry. The success or failure of kspn stock, relative to competitors, is significantly influenced by the overall competitive forces.

In summary, careful consideration of industry trends is paramount for evaluating kspn stock. Understanding how technological advancements, regulatory changes, shifts in consumer behavior, and the competitive landscape impact the industry provides a deeper understanding of the company's position and future prospects. The interplay of these factors is crucial for informed investment decisions.

4. Earnings per share

Earnings per share (EPS) represents a crucial component of evaluating kspn stock. It quantifies the portion of a company's profit allocated to each outstanding share of common stock. A higher EPS often indicates greater profitability and, consequently, a potentially more attractive investment. Conversely, declining EPS can signal financial distress or market challenges, potentially negatively impacting the stock's value. The relationship between EPS and kspn stock is a direct one, where EPS acts as a key performance indicator reflecting the underlying financial health and market position of the company.

The significance of EPS as a component of kspn stock stems from its direct correlation with investor confidence and stock valuation. Investors often prioritize companies with consistent and growing EPS, as this suggests a well-performing and financially sound organization. Companies that demonstrate strong EPS performance are often seen as more attractive investments, potentially leading to higher stock prices. For instance, if kspn consistently reports favorable EPS figures against historical data and industry benchmarks, it might attract more investment, leading to a higher stock price. Conversely, a sudden drop in EPS might trigger investor concerns, resulting in a decrease in demand and lower stock prices. Historical data of kspn's EPS trends, alongside its industry peers, reveals crucial insights into its performance trajectory and relative standing.

In conclusion, EPS is a vital metric for understanding the financial health of a company like kspn. Its direct relationship with investor confidence and stock valuation makes it a pivotal component in evaluating kspn stock. Investors must carefully analyze EPS trends alongside other factors, such as revenue growth, market share, and industry conditions, for a complete picture of a company's financial health and future potential. While EPS serves as a critical indicator, it shouldn't be the sole factor in investment decisions. A comprehensive evaluation considers various metrics to arrive at a more informed assessment of investment risk and return.

5. Executive Leadership

Executive leadership profoundly impacts the performance and value of kspn stock. Effective leadership fosters a company culture that prioritizes innovation, efficiency, and strategic decision-making. These qualities translate directly into financial performance and market responsiveness. Strong leadership inspires trust among investors, fostering a positive perception of the company and its stock. Conversely, leadership perceived as weak or ineffective can negatively impact investor confidence, potentially leading to a decline in stock value.

The quality of executive leadership significantly influences a company's ability to adapt to market changes and seize opportunities. Visionary leaders adept at strategic planning can guide the company through market fluctuations, fostering resilience and maintaining investor confidence. Competent leadership often translates to sound financial management, improved operational efficiency, and ultimately, higher profitability. This positive correlation directly benefits the stock price. Conversely, leadership lacking foresight or strategic acumen can lead to missed opportunities, increased risk, and a decline in investor confidence, which negatively affects kspn stock. Consider, for instance, a company experiencing rapid industry transformation. Strong leadership will guide strategic adjustments, potentially securing long-term growth. Weak leadership could result in missed opportunities and decreased shareholder value.

Understanding the connection between executive leadership and kspn stock is crucial for investors. Strong leadership provides a sense of stability and predictability, enhancing the perceived value of the stock. Investors often seek companies with proven leadership teams who exhibit clear strategies and the ability to navigate challenges. A thorough evaluation of the executive team's experience, expertise, and track record in similar industries offers valuable insight into a company's potential. The analysis necessitates considering the leadership team's communication with investors and the overall culture they foster. This understanding allows investors to make more informed decisions regarding their investment in kspn stock, taking into account the potential impact of leadership's actions on future performance.

6. Company Valuation

Company valuation is a critical component in understanding kspn stock. Determining the intrinsic worth of a company is fundamental to assessing its investment potential. Valuation methods, such as discounted cash flow analysis, comparable company analysis, or asset-based valuation, provide frameworks to estimate the fair market value. The results of these assessments directly influence the perceived value of kspn stock, impacting investor decisions and the stock's price fluctuations. For instance, if an independent valuation suggests a higher intrinsic worth than the current market price, the stock could be considered undervalued, potentially attracting investors and driving up the price. Conversely, if the valuation indicates a lower intrinsic value, it might signal potential undervaluation, deterring some investors and possibly leading to lower stock prices.

Various factors contribute to a company's valuation. Profitability, revenue growth, market share, competitive advantages, and future prospects are major considerations. A company's financial health, as reflected in its balance sheet and income statement, plays a significant role. If kspn demonstrates consistent profitability and strong revenue growth, this will likely improve its valuation and contribute to a positive outlook on kspn stock. Conversely, persistent losses, significant debt, or declining market share could negatively impact valuation and investor sentiment concerning kspn stock. External factors, like macroeconomic conditions and industry trends, also affect valuation. A robust economic environment typically supports higher valuations, whereas economic downturns tend to depress valuations, which is also pertinent to understanding kspn stock's movement in those periods. The interplay between these internal and external factors is crucial for evaluating the fair value of kspn stock.

In summary, company valuation directly influences the perception and price of kspn stock. A thorough understanding of valuation methods and the factors impacting valuation, including financial performance, competitive landscape, and macroeconomic conditions, is essential for investors. Accurate valuation analysis provides a framework for determining whether the stock is overvalued, undervalued, or fairly priced, assisting in making informed investment decisions. However, valuation is a complex process with inherent uncertainties, and investors must consider various methodologies and potential limitations for a complete picture when assessing kspn stock. The accuracy and reliability of valuation analyses often depend heavily on the specific methodologies used and the quality and availability of input data.

7. Stock Price Volatility

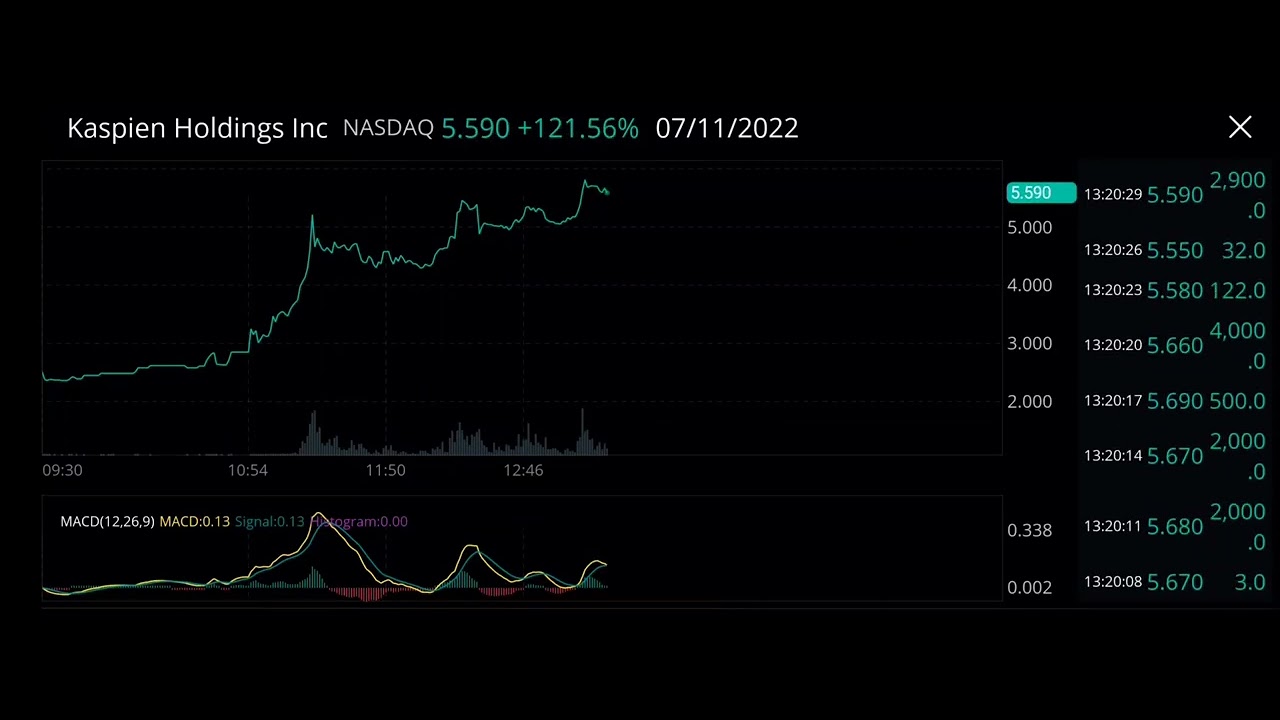

Stock price volatility, the degree to which a stock's price fluctuates over time, is a significant factor for investors evaluating kspn stock. Understanding this volatility is essential for assessing risk and return potential. High volatility typically indicates a greater potential for both significant gains and substantial losses, whereas low volatility suggests a more stable price trajectory. This characteristic must be carefully considered alongside other factors when examining kspn stock's investment profile.

- Market Sentiment and News Events

Significant shifts in market sentiment, often triggered by company-specific news or broader market trends, can drive substantial stock price fluctuations. Positive news, such as strong earnings reports or favorable industry developments, can lead to upward price movements. Conversely, negative news, including financial setbacks, regulatory concerns, or industry downturns, often precipitates price declines. The impact of these events on kspn stock hinges on the specific nature of the news and the broader market context.

- Company Performance and Financial Health

Fluctuations in a company's financial performance directly correlate with stock price volatility. Strong financial results typically lead to increased investor confidence and a potentially more stable price. Conversely, poor financial performance can generate significant uncertainty and cause larger price swings. For kspn stock, consistent profitability and revenue growth contribute to a lower volatility profile. Conversely, unpredictable financial outcomes can exacerbate price fluctuations.

- Economic Conditions and Industry Trends

Broader economic conditions and industry trends exert considerable influence on stock price volatility. During periods of economic uncertainty or industry downturns, stock prices are often more volatile. Conversely, a stable and prosperous economic climate generally leads to lower volatility. Analyzing how broader economic forces affect the industry to which kspn belongs is critical to understanding the potential volatility of its stock.

- Trading Volume and Liquidity

High trading volume and sufficient liquidity are associated with lower volatility, as rapid trading can absorb price changes. Limited trading volume, conversely, often leads to greater price swings. Assessing the trading volume and liquidity of kspn stock offers insights into the responsiveness of the market to price changes. Understanding the trading patterns and liquidity of the specific stock, especially during periods of significant market movements, allows investors to predict and mitigate possible risks linked to volatility.

In conclusion, analyzing the volatility of kspn stock requires a comprehensive approach. Examining market sentiment, company performance, economic conditions, and trading volume alongside other factors provides a clearer picture of the potential risks and rewards associated with investing in this stock. Investors must carefully weigh these elements in their decision-making process to determine how the stock's price volatility fits within their overall investment strategy.

8. Dividend History

Dividend history provides a crucial perspective for evaluating kspn stock. Dividend payments, when consistently delivered, often signal a company's financial health and stability. Understanding past dividend patterns assists in predicting future payouts and assessing the potential return on investment. Analysis of dividend history can illuminate a company's commitment to rewarding shareholders and its capacity to generate sustainable income, contributing to the overall evaluation of kspn stock's investment potential.

- Consistency and Stability of Dividend Payments

A consistent history of dividend payments demonstrates the company's ability to generate reliable profits and allocate funds to shareholders. Stable dividend payouts often indicate a financially secure company capable of sustaining operations and maintaining profitability through various economic cycles. Fluctuations or complete cessation of dividend payments, on the other hand, may signal financial distress or a shift in strategy, potentially impacting the attractiveness of kspn stock. An absence or discontinuity in dividend payments could represent a negative factor affecting investor confidence in the long-term value of the stock.

- Dividend Growth Patterns

The rate of dividend growth provides insights into a company's growth potential. Consistent increases in dividends suggest the company is expanding its profitability and is confident in its future, potentially leading to higher stock valuations. Conversely, a stagnant or declining dividend history might indicate limitations in growth or a shift in company strategy. Growth patterns, compared with industry peers, provide valuable context for judging the relative performance of kspn stock and its competitiveness.

- Dividend Yield and its Relation to Market Conditions

Dividend yield, calculated as the annual dividend per share divided by the share price, can help determine the attractiveness of kspn stock relative to its peers and other available investment vehicles. A higher dividend yield, compared to competitors or prevailing market rates, might signal an attractive investment opportunity. However, a low or declining dividend yield could reflect a less attractive investment option. Assessment of the dividend yield against market trends and competitor yields provides a comprehensive picture of kspn stock's value proposition within the current investment landscape.

- Impact on Valuation and Investor Confidence

Dividend history significantly influences company valuation. A history of robust dividend payments often strengthens investor confidence and elevates a company's perceived value, potentially supporting higher stock prices for kspn. Conversely, inconsistent or absent dividends can reduce investor confidence, potentially leading to downward pressure on the stock's price. The analysis of dividend history informs investors about the company's commitment to shareholders, enhancing their understanding of kspn stock's long-term investment potential.

In conclusion, a detailed review of kspn's dividend history reveals critical insights into its financial health, growth potential, and commitment to shareholders. By considering dividend consistency, growth patterns, yield, and its impact on valuation, investors can gain a more comprehensive understanding of the investment potential embedded within kspn stock. Comparing these metrics with industry benchmarks provides further context for evaluating the attractiveness of kspn stock against its competitors. However, dividend history should be viewed alongside other crucial factors when making investment decisions.

Frequently Asked Questions about kspn Stock

This section addresses common inquiries regarding kspn stock, providing concise and informative answers. Understanding these key points will enhance comprehension of investment considerations associated with this particular entity.

Question 1: What is kspn stock?

kspn stock represents ownership in a specific publicly traded company. Investors purchase shares to participate in the company's potential growth and profit from price fluctuations in the stock market. This ownership offers a financial stake in the company's performance and future prospects.

Question 2: How can I assess the value of kspn stock?

Multiple factors contribute to kspn stock's valuation. Key elements include the company's financial performance, industry trends, market capitalization, earnings per share, executive leadership, and overall market sentiment. Various valuation methods, such as discounted cash flow analysis, can provide estimations of intrinsic worth, compared to the current market price. Careful consideration of these metrics offers a more comprehensive perspective.

Question 3: What are the risks associated with investing in kspn stock?

All investments carry inherent risks. kspn stock's price can fluctuate based on various factors including market conditions, economic trends, industry dynamics, and company-specific performance. Investors should thoroughly research the company and its industry to better understand potential risks before making any investment decision.

Question 4: What are the potential benefits of investing in kspn stock?

Potential benefits stem from the company's growth potential and market position. Successful operations can result in increased profitability, higher earnings per share, and ultimately, an increase in the stock price. However, past performance does not guarantee future results.

Question 5: Where can I find more information about kspn stock?

Investors seeking further details should consult reputable financial news sources, company filings, and investment research platforms. These resources offer in-depth analyses and insights regarding the stock's performance and market implications. Transparency and accessibility are vital when evaluating investment opportunities.

In summary, understanding kspn stock involves a comprehensive evaluation of various factors. Thorough research, informed analysis, and careful consideration of potential risks and benefits are crucial for successful investment decisions.

This concludes the FAQ section. The following section will delve into a more detailed analysis of kspn stock.

Conclusion

This analysis of kspn stock explored key factors impacting its value and potential. Market capitalization, financial performance metrics like earnings per share, industry trends, executive leadership, and valuation methods were examined. The volatility of the stock price, influenced by market sentiment, economic conditions, and the company's own performance, was also considered. Dividend history offered a perspective on the company's commitment to shareholders and its ability to generate sustainable income. Ultimately, a thorough understanding of these elements provides a more complete picture of the risks and rewards associated with an investment in kspn stock. The evaluation underscored that no single factor definitively dictates the stock's future trajectory but rather a confluence of interacting forces.

Investors considering kspn stock must carefully weigh the multifaceted analysis presented here. This detailed examination highlights the necessity of a comprehensive understanding of the company's financial health, competitive landscape, and leadership. Further research and due diligence are crucial before making any investment decisions. Future performance hinges on a variety of unpredictable external and internal factors. Continued vigilance and critical evaluation of evolving market conditions are essential for informed investment strategies regarding kspn stock and similar entities.

Article Recommendations

.png)