Understanding the historical dividend payouts of a specific investment vehicle is crucial for investors. A comprehensive record of past distributions provides valuable insight into the potential for future payouts.

Dividend history encompasses a record of the amounts and dates of any cash payments made to investors by a company. For example, if a company distributes a dividend of $1 per share on a quarterly basis, the history will show the payout dates and amounts for each quarter over a given period, such as the last five years. This data can include any special or extra dividends paid beyond the standard schedule.

Analyzing dividend history offers several benefits to investors. It reveals the company's financial stability and ability to consistently distribute income. A steady record of dividend payments suggests a resilient company, capable of generating reliable profits. This historical data can help assess the company's long-term commitment to rewarding its investors. Furthermore, comparing dividend payouts over time can identify trends and potential future patterns. For instance, a company with an increasing dividend payout over the years could signal strong revenue growth and sustainable profitability, suggesting further potential future gains for investors. Conversely, fluctuating or declining dividend payouts might suggest potential risks or changes in the company's operations.

Moving forward, a thorough understanding of dividend history will be essential for evaluating the investment potential and risk associated with the specific entity (or entities) under review. Further exploration of the company's financial statements and overall performance will offer additional context and insight.

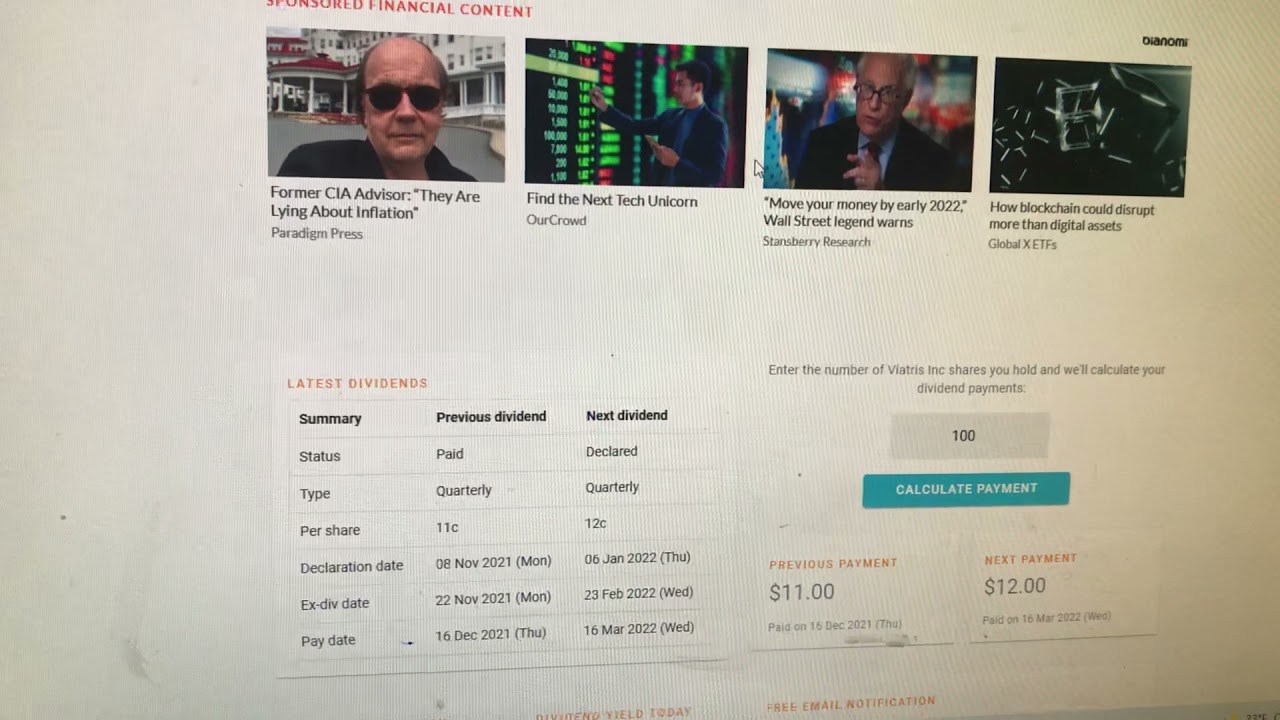

VTRS Dividend History

Understanding VTRS' dividend history is crucial for investors to assess potential returns and financial stability. This data reveals patterns, trends, and the long-term commitment to dividend payouts.

- Payout Amounts

- Payment Frequency

- Consistency

- Trend Analysis

- Historical Context

- Impact on Valuation

VTRS' dividend history, encompassing payout amounts and frequency, demonstrates the company's ability to generate consistent income for investors. Analysis of historical trends, such as increasing or decreasing payouts, provides insight into underlying financial health. A history of consistent dividends signals stability and potential for future growth, while fluctuating payouts might suggest financial risk. Understanding the historical context of these payments, considering market conditions and company performance, enhances the interpretation. This also helps assess how dividend payouts impact the investment's overall valuation. For example, a steady increase in dividends over time can suggest strong revenue growth, while decreased or irregular payments may indicate challenges. Therefore, assessing VTRS' dividend history is critical in constructing a complete investment picture.

1. Payout Amounts

Payout amounts represent a critical component of VTRS dividend history. The size of dividend payments directly affects the financial return for investors. Analyzing historical payout amounts reveals patterns and trends indicative of the company's financial performance and commitment to distributing earnings. For example, a consistent increase in payout amounts over time suggests increasing profitability and a commitment to growing dividends. Conversely, decreasing or fluctuating amounts might indicate underlying financial challenges or shifts in business strategy. Understanding the relationship between payout amounts and overall financial health is paramount for informed investment decisions.

Consider a scenario where VTRS consistently increases its dividend payouts over several years, correlating with significant revenue growth and sustained profitability. This positive trend signals the company's ability to generate consistent earnings and its confidence in future growth, supporting a positive outlook for future payouts. Conversely, if VTRS's payout amounts have been declining, this could indicate a struggle to maintain profitability or a shift in financial priorities, potentially warranting further investigation and assessment of alternative investments. The magnitude of these changes in payout amounts, alongside other financial indicators, is crucial to understanding the underlying financial health and future prospects of VTRS.

In summary, the historical record of VTRS's dividend payout amounts is vital. It's a crucial indicator of the company's financial stability and its commitment to rewarding investors. Understanding the trend in payout amounts is not merely a historical record, but rather a key element in assessing the potential for future returns and the overall financial health of the investment. Careful evaluation of payout amounts, along with other financial data, is indispensable for making sound investment choices regarding VTRS.

2. Payment Frequency

Payment frequency, a crucial element within VTRS dividend history, signifies the regularity with which dividends are distributed. This regularity reflects the company's financial stability and its ability to consistently generate earnings. A predictable payment schedule, such as quarterly or annually, suggests a reliable income stream for investors, indicating a strong capacity to generate profit and manage resources. Conversely, an erratic or inconsistent payment schedule can signal potential financial instability or changes in operational strategy that necessitate further investigation. Understanding the historical frequency of dividend payments provides investors with insights into the company's financial health and predictability.

Consider a company maintaining a consistent quarterly dividend payment over several years. This pattern signifies a predictable cash flow, demonstrating the company's confidence in its ability to consistently generate revenue. Investors can rely on this consistent income stream, potentially boosting confidence in the long-term viability of their investment. However, if the frequency shifts, potentially moving from quarterly to annual or becoming sporadic, this might suggest operational challenges, changes in financial strategy, or even potential difficulties in generating the necessary funds. These changes require a critical review of the company's financial reports and overall performance. A sudden shift in frequency without explanation merits heightened attention and scrutiny.

In conclusion, the frequency of dividend payments, as part of VTRS's dividend history, provides valuable insights into financial stability and operational reliability. A consistent payment schedule suggests financial strength and predictable returns. Conversely, inconsistencies or changes in frequency might point towards potential financial difficulties, prompting investors to conduct a comprehensive evaluation of the company's financial position and future prospects before making any investment decisions. Thorough examination of this aspect of VTRS's dividend history is critical for informed investment strategies.

3. Consistency

Consistency in dividend payments forms a crucial element within VTRS's dividend history. A consistent record signifies financial stability and reliability, suggesting the company's ability to generate sustained profits. This predictability can attract investors seeking a reliable income stream. Conversely, inconsistent dividend payouts raise concerns about the company's financial health and operational stability, potentially discouraging investment and prompting further investigation.

The importance of consistency stems from its impact on investor confidence. Investors rely on predictable income streams for financial planning and budgeting. A consistent dividend history builds investor trust and loyalty. This trust can translate to increased investment, providing a positive feedback loop for the company. Consider companies with a history of consistent dividend growth; they often experience higher valuations and sustained investment interest. Examples of companies that have built reputations for reliable dividend payouts are found across various sectors. This consistency demonstrates their ability to navigate economic fluctuations and maintain a commitment to rewarding investors.

Analyzing the consistency of dividend payments within VTRS's history allows investors to assess the company's financial stability and commitment to shareholder value. Fluctuations in the payment frequency or amount can signal potential underlying issues within the company's operations. Investors must carefully scrutinize these signals in conjunction with other financial data to form a comprehensive investment strategy. This approach considers the specific context of VTRS and avoids oversimplification. Identifying trends in consistency, alongside other performance indicators, offers a more nuanced perspective on the company's long-term prospects.

4. Trend Analysis

Trend analysis of VTRS' dividend history is essential for informed investment decisions. Examining past dividend payouts reveals patterns and insights into potential future behavior. A consistent upward trend suggests increasing profitability and a commitment to shareholder returns, potentially signaling higher future payouts. Conversely, a downward trend might indicate financial pressures or shifts in strategy that merit closer scrutiny. Fluctuations in the dividend trend necessitate further investigation into the underlying causes, considering economic conditions, market factors, and company performance. Identifying trends aids in forecasting future dividend distributions and evaluating the investment's risk and reward profile. Understanding historical trends aids in anticipating potential challenges or opportunities.

Real-world examples illustrate the practical significance of trend analysis. A company consistently increasing its dividend payouts over several years demonstrates financial stability and growth potential. Investors can often anticipate future dividend increases based on this historical trend. Conversely, a company experiencing erratic or declining dividend payouts may signal underlying financial difficulties, potentially necessitating a re-evaluation of the investment. Examining historical trends helps gauge potential risks and rewards more effectively. Understanding historical patterns in dividend distribution provides valuable context for assessing the current dividend and forecasting future ones. The interplay between company performance and dividend payout patterns, as evidenced in the historical data, is crucial for informed investment strategies. This analysis allows for a more comprehensive understanding of the investment's long-term potential and associated risks.

In conclusion, trend analysis of VTRS' dividend history is invaluable for evaluating investment potential. By identifying patterns in past dividend payouts, investors gain insights into the company's financial health and commitment to shareholders. This knowledge facilitates informed decision-making and helps in forecasting future dividend distributions. However, trend analysis is only one piece of the investment puzzle, requiring a holistic assessment of other financial metrics and market conditions to form a comprehensive investment strategy. Recognizing the limitations of relying solely on historical trends while incorporating other critical data is crucial for maximizing investment returns while minimizing associated risks. Understanding the relationship between trends and the overall financial health of VTRS is critical for successful investment outcomes.

5. Historical Context

Historical context plays a critical role in interpreting VTRS' dividend history. Understanding the economic conditions, industry trends, and company performance during various periods is essential for evaluating the rationale behind dividend decisions. A company's dividend policy is not static; it's often influenced by external factors. For instance, during periods of economic recession or industry downturn, a company might reduce or suspend dividend payments to conserve cash and prioritize operational stability. Conversely, strong economic growth and increasing industry profits often correlate with higher dividend payouts. A historical analysis should consider these external pressures alongside internal factors such as capital expenditure, mergers, or significant changes in leadership.

Analyzing historical dividend payments within the context of the broader economic landscape offers crucial insights. A company might maintain a relatively stable dividend payout despite external pressures if it has strong cash reserves and consistent revenue generation. Conversely, a company facing declining profits or industry-wide challenges may be forced to curtail or eliminate dividend payments, even if the trend previously suggested otherwise. Examples include comparing VTRS' dividend history during periods of rapid technological advancement with periods of relative stagnation in the industry. Such comparisons highlight how external factors, such as competitive landscapes or regulatory changes, can impact a company's ability to generate profits and its capacity to distribute dividends. Careful consideration of historical context is vital for assessing the sustainability and credibility of the dividend pattern.

In conclusion, historical context provides a crucial framework for interpreting VTRS' dividend history. It allows for a deeper understanding of the factors influencing dividend decisions, moving beyond a simple numerical analysis. By examining the historical relationship between dividend payments and economic/industry conditions, investors can gain a more comprehensive picture of the company's long-term financial health and the reliability of its dividend payments. Investors who consider historical context will be better positioned to assess the risks and rewards associated with VTRS' dividend strategy and make more informed investment decisions.

6. Impact on Valuation

The historical dividend payments of VTRS directly influence its valuation. A consistent and increasing dividend pattern often suggests financial strength, attracting investors seeking a reliable income stream. Conversely, irregular or decreasing dividends can signal financial challenges and potentially lower investor confidence, affecting the valuation. This connection demands careful consideration when assessing VTRS' overall investment merit.

- Dividend Consistency and Valuation Stability

A consistent dividend track record, especially when combined with revenue growth, often results in a higher valuation. Investors perceive this as a sign of financial stability and a commitment to long-term shareholder value. Consistent dividend payouts increase investor confidence, which can positively impact share price. Companies with a history of reliable dividends tend to command higher valuations compared to companies with erratic or inconsistent payouts.

- Dividend Growth and Valuation Appreciation

Growth in dividend payments over time signifies a company's ability to generate increasing profits and reinvest earnings profitably. Investors often associate this growth with future potential returns, leading to an upward valuation trend. Companies demonstrating consistent dividend growth frequently attract a higher valuation multiple compared to their peers.

- Dividend Cuts and Valuation Volatility

Reductions in dividend payments or a complete cessation of payouts can significantly impact valuation. Investors perceive such actions as a potential sign of financial distress, leading to decreased investor confidence and potential share price volatility. The impact on valuation can be substantial, potentially leading to a decline in the overall valuation and increased investment risk perception. A sudden shift in dividend policy requires careful scrutiny of the underlying causes and potential implications for future returns.

- Valuation Multiples and Dividend Yield

Valuation multiples, like the price-to-earnings ratio or price-to-book ratio, are often correlated with the dividend yield. A higher dividend yield, representing a higher proportion of the share price paid out in dividends, can justify a higher valuation multiple, assuming the dividend is sustainable. Conversely, a low dividend yield could indicate a lower valuation multiple, unless other factors, such as strong growth prospects or future dividend growth potential, outweigh this.

In conclusion, VTRS' dividend history is a crucial factor in assessing valuation. A comprehensive analysis should consider the consistency, growth, and potential implications of changes in dividend payments. The relationship between dividend performance and valuation provides valuable insights for investors, informing their decisions regarding VTRS' investment potential. However, dividend history is just one component in a comprehensive valuation analysis, and other factors, such as the overall financial health of the company and industry trends, also play a significant role. A thorough analysis necessitates a holistic perspective.

Frequently Asked Questions about VTRS Dividend History

This section addresses common inquiries regarding the dividend history of VTRS. Understanding this information can help investors make informed decisions. A comprehensive review of the dividend history, considering various aspects, is crucial.

Question 1: How can I access VTRS's dividend history?

Accessing VTRS's dividend history typically involves reviewing publicly available financial reports and investor relations materials. Financial news websites and dedicated investment platforms often provide access to historical dividend information, frequently updated as available. Directly contacting VTRS' investor relations department could offer additional details and resources.

Question 2: What does a consistent dividend payout pattern signify?

A consistent dividend payout pattern suggests financial stability and a commitment to shareholder returns. This predictability often signifies a company's ability to generate consistent profits and manage resources effectively. However, consistent dividends do not guarantee future returns.

Question 3: How do fluctuating dividends impact investment decisions?

Fluctuating dividends warrant careful consideration. Significant fluctuations may indicate underlying financial issues or changes in the company's operational strategy. Evaluating the company's financial statements and overall performance alongside the fluctuation data is essential for forming an informed investment strategy. Other factors, like market conditions, should also be considered.

Question 4: What is the importance of historical context when evaluating dividend history?

Historical context is critical when analyzing dividend history. Understanding the broader economic or market conditions and the company's performance during different periods helps in interpreting dividend decisions. Analyzing payouts relative to these broader factors helps in assessing the dividend's sustainability.

Question 5: How does dividend history affect the valuation of VTRS?

A consistent and increasing dividend history can positively influence valuation. This signals financial strength and the commitment to returning value to shareholders, leading to a higher perceived value. However, other factors, such as the company's overall financial health and market conditions, also significantly influence valuation.

Understanding VTRS's dividend history involves a multifaceted approach, combining analysis of historical payout data with an understanding of economic and industry contexts. A thorough assessment considers the factors mentioned above in conjunction with other pertinent information before making investment decisions.

Moving forward, a more in-depth exploration of the company's financials and performance metrics will provide a complete picture of VTRS's current state and potential future returns.

Conclusion

VTRS' dividend history provides a crucial lens through which to assess the company's financial stability and commitment to shareholders. A consistent and increasing dividend payout often reflects underlying profitability and a dedication to rewarding investors. Conversely, inconsistent or declining dividends may indicate financial challenges requiring further investigation. Key aspects of this history include the amounts and frequency of payments, alongside the overall trend over time. Understanding historical context, encompassing economic and industry conditions, is vital in interpreting these payments. Furthermore, the relationship between dividend performance and valuation requires careful consideration. A comprehensive analysis of VTRS' dividend history, incorporating these various elements, allows for a more nuanced evaluation of its investment merit.

Ultimately, evaluating VTRS's dividend history is just one piece of a larger investment puzzle. While this analysis provides insights into financial stability and shareholder returns, a complete investment strategy necessitates a thorough assessment of VTRS' overall financial health, management, and industry position. Investors should not rely solely on dividend history, but use this information in conjunction with other financial data and market analyses to formulate well-informed investment decisions. Ongoing monitoring of VTRS' financial performance and dividend patterns remains essential for adapting strategies in a dynamic investment landscape.

Article Recommendations